Financial Advisors Illinois Fundamentals Explained

All About Financial Advisors Illinois

Table of ContentsFinancial Advisors Illinois Fundamentals ExplainedSome Known Factual Statements About Financial Advisors Illinois The Definitive Guide to Financial Advisors IllinoisAll About Financial Advisors IllinoisSome Ideas on Financial Advisors Illinois You Should KnowA Biased View of Financial Advisors IllinoisFacts About Financial Advisors Illinois Revealed

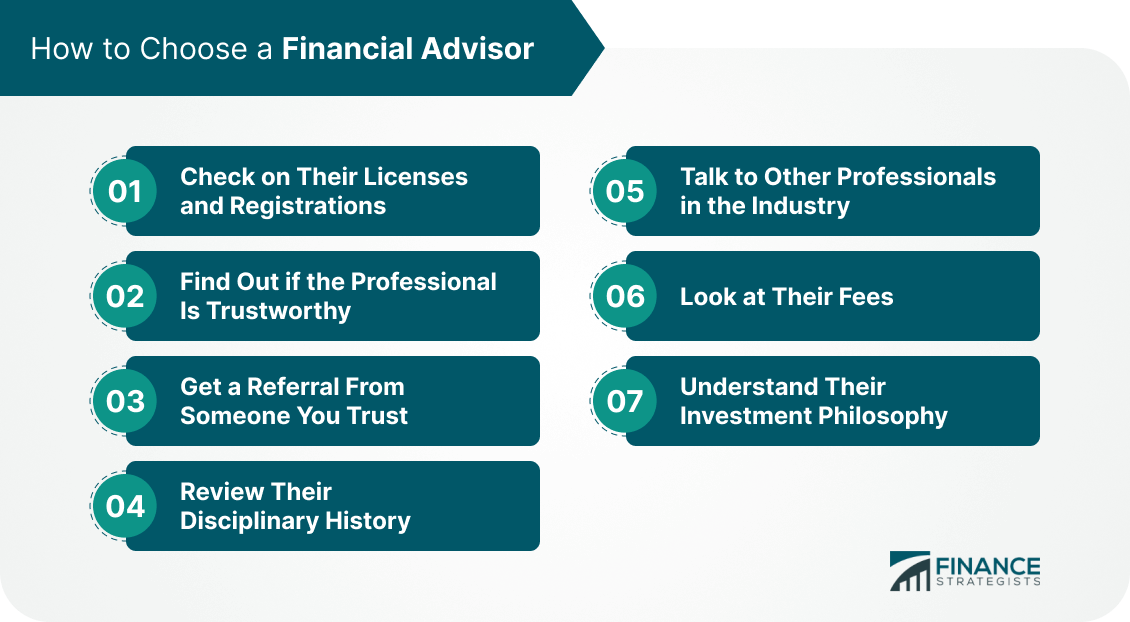

motilal-oswal: tags/others What are the characteristics of an excellent economic advisor? That is always a tough inquiry to answer due to the fact that it involves a mix of measurable and qualitative factors. There is the basic issue of expert skills and certifications. Yet there is something much more qualitative and emotional about a financial advisor that offers comfort to you.Nevertheless, it is a connection of trust and you need to nurture it over an amount of time. 10 Qualities you must look for in your economic advisorYou needs to try to find a mix of quantitative and qualitative consider your monetary expert. Above all, likewise focus on the psychological ratio.

Try to find correct scholastic qualifications. You can say that official education and learning is not whatever however you need to focus on this facet for 2 reasons. An official education and learning subjects you to big body of understanding which includes products and techniques. A formal education instils roughness in a financial expert and the most standard high quality you are looking for in your expert is the roughness to deal with mountains of information and make sense of the very same.

The Main Principles Of Financial Advisors Illinois

2. Seek their track record in the market. You can always dig around and ask individuals that are much more going to share information. Keep in mind, great track record and poor track record normally precedes monetary advisors out there. A great online reputation is important due to the fact that you are entrusting your economic futures and surely desire somebody that is ethically above board.

Is your financial consultant proactive? A financial advisor can not be waiting for a crisis and then respond to it.

Ensure that your monetary expert does not have any dispute of rate of interest. Is your consultant charging you costs or is he earning payments from principals for marketing their products. Examine if the expert is likewise functioning with various other gamers in the financial industry as a consultant.

Is your financial consultant having a full support team with advisors, analysts and executives? At the end of the day you require services not simply consultancy from your expert.

The Definitive Guide for Financial Advisors Illinois

Excessive dependancy on a single person is not a great concept. 8. Is the advisor making you the centrepiece of the entire discussion? That is precisely what you desire. You do not desire a consultant that invests more time describing products and benefits. You are extra thinking about items and remedies that are workable for you.

We make use of cookies on our internet site to give you one of the most pertinent experience by remembering your choices and repeat check outs. By clicking "Accept", you consent to the usage of ALL the cookies.

Comprehending just how your advisor is paid guarantees that their motivations straighten with your benefits, promoting a relied on, clear connection. Additionally, it's critical to make certain that your monetary consultant has the appropriate credentials and experience. Certifications like Qualified Monetary Coordinator (CFP), Chartered Financial Expert (CFA), and various other professional classifications demonstrate a consultant's commitment to sticking to industry standards and preserving their proficiency.

Some Known Facts About Financial Advisors Illinois.

That's why Select Advisors Institute is the leading selection for executive presence training. Here's why: Customized Leadership Training for Financial Advisors: At Select Advisors Institute, we don't supply one-size-fits-all training. Rather, our technique is personalized to the one-of-a-kind demands of economic consultants. We focus on helping Going Here them improve their personal management high qualities, communication design, and ability to affect clients.

As an investor, the secret to choosing the ideal economic consultant is discovering somebody who not just has technological experience however also the ability to connect with authority and lead with confidence. If you're seeking an economic consultant who has remarkable management abilities, look for one that has actually gone through executive visibility training.

SEO Meta Description (110 words): Seeking a trusted financial advisor? Executive presence is key. Select Advisors Institute supplies # 1 exec existence training for financial leaders, assisting them establish the leadership abilities needed to interact with quality, self-confidence, and authority. Our tailored mentoring enhances both in-person and on-line customer interactions, making it possible for experts to develop trust and foster strong partnerships.

At Select Advisors Institute, our company believe that the most trusted economic consultants are those that show not only extraordinary technical acumen however additionally the management qualities that infuse self-confidence and count on. Below's how to evaluate whether a person is genuinely the right fit for you and why executive visibility plays an essential role in the assessment.

All About Financial Advisors Illinois

Right here's why: Confidence: A monetary consultant with exec presence emanates a sense of self-confidence and tranquility, also in high-pressure situations. This reassures clients that their economic future is in qualified hands. Clarity: Great consultants are outstanding communicators. They can damage down intricate monetary concepts right into clear, actionable steps that customers can quickly comprehend.

Furthermore, consider their performance history; ask for client reviews or evaluations to evaluate their success in aiding clients accomplish economic goals. In addition, the compatibility between a financier and their consultant plays a crucial function in the advising partnership (Financial Advisors Illinois). A reliable economic advisor ought to demonstrate excellent interaction abilities, actively listen to your requirements, and dressmaker strategies that line up with your economic objectives

10 Simple Techniques For Financial Advisors Illinois

In addition, examine their experience in the financial sector and whether they have managed clients in circumstances comparable to your own. An all-around advisor ought to not only have the technical understanding but likewise the social skills to lead you through facility monetary choices with confidence. In your directory look for a trusted monetary advisor, do not forget the significance of a clear charge structure.

Keep in mind that a truly leading rated expert prioritizes your benefits most of all, using impartial recommendations and showing integrity throughout the relationship. By taking a detailed approach and maintaining open discussion, you encourage on your own to make smarter economic decisions that align with your life objectives (Financial Advisors Illinois). If you have questions or want tailored support, do not be reluctant to reach out

If you have any one of these posts, call us1. What kind of economic expert should I choose for retirement planning? 2. Exactly how do I locate a relied on monetary expert near me? 3. What concerns should I ask an economic expert prior to employing? 4. Exactly how a lot does an economic consultant expense? 5.

The Of Financial Advisors Illinois

When assessing possible experts, pay attention to their experience with customers whose financial situations resemble your own, their approach to run the risk of monitoring, and their readiness to inform you about investment options and market problems. Ensure they adhere to a fiduciary standard, meaning they my response are lawfully required to act in your best passion at all times.

Just how do I discover an economic advisor near me? 2. What concerns should I ask a monetary consultant before working with? 3. Exactly how to verify a monetary consultant's credentials and history? 4. What is the difference between a fiduciary and a non-fiduciary advisor? 5. Just how a lot does an economic advisor price? 6.